Lesson 2 of 6

COVID-19 Medicare Telehealth Billing

Medicare: FQHC/RHC Billing as a Distant Site

CMS originally released MLN SE20016 on April 17, 2020 detailing payment for FQHCs/RHCs during the public health emergency. On April 30, 2020, and again on July 6, 2020 CMS updated the previously mentioned MLN. See the latest Jun 2021 MLN901705.

Distant site telehealth services can be furnished by any health care practitioner working for the clinic within their scope of practice. The practitioners can furnish the telehealth services from any distant site location, including their homes, during the time they are working for the RHC or FQHC.

- RHCs and FQHCs can bill Medicare for telehealth services as distant site providers, at a reimbursement rate of $97.24 for claims submitted between January 1, 2022-December 31, 2022.

- The patient’s home is an eligible originating site, as of March 6, 2020.

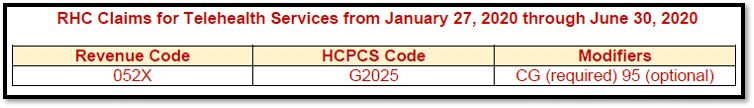

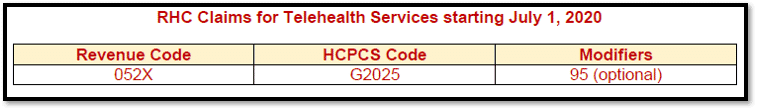

Per the CMS MLN: For RHC telehealth distant site services starting July 1, 2020 through the end of the public health emergency:

- Telehealth services, for established patients only, will be billed with G2025

- Appending modifier 95 is optional

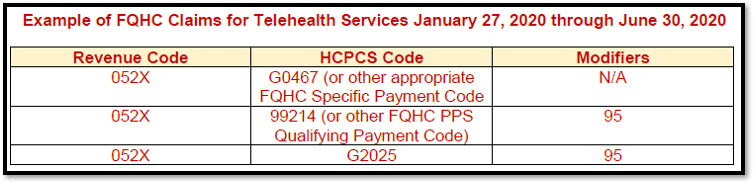

Per the CMS MLN: For FQHC qualifying telehealth visits furnished from January 27, 2020 through June 30, 2020:

- Bill using the FQHC PPS specific payment code (GO466, G0467, G0468, G0469, or G0470) and;

- The HCPCS/CPT code that describes the services furnished via telehealth with modifier 95 and;

- G2025 with modifier 95

- POS is equivalent to where the service would have been rendered in person

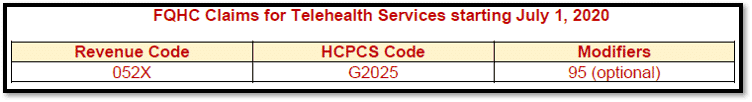

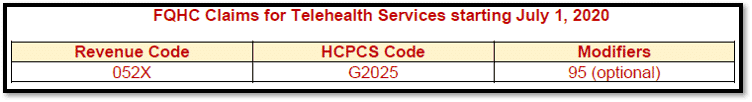

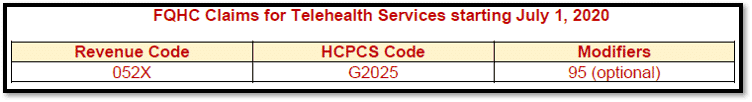

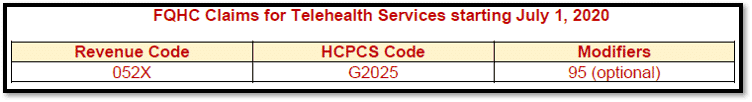

Per the CMS MLN: For FQHC qualifying telehealth visits furnished beginning July 1, 2020 through the end of the public health emergency:

- Bill using G2025 for established patients only

- Modifier 95 is optional

Per the MAC (Noridian): For FQHC qualifying telehealth visits BILLED July 1, 2020 through the end of the public health emergency:

- Bill using G2025

- Modifier 95 is optional

Medicare Advantage Wrap Payments:

Since telehealth distant site services are not paid under the RHC AIR or the FQHC PPS, the Medicare Advantage (MA) wrap-around payment does not apply to these services. Wrap-around payment for distant site telehealth services will be adjusted by the MA plans.

Audio Only Billing for FQHCs & RHCs

Effective March 1, 2020 FQHCs and RHCs can furnish and bill for audio-only (telephone) E/M services.

Bill these services using HCPCS code G2025.

To bill for these services, at least 5 minutes of telephone E/M service by a physician or other qualified health care professional who may report E/M services must be provided to an established patient, parent, or guardian. These services cannot be billed if they originate from a related E/M service provided within the previous 7 days or lead to an E/M service or procedure within the next 24 hours or soonest available appointment.

COVID-19 Testing and Treatment: Waiving of Cost Sharing

NOTE: COVID-19 Guidelines are updated frequently!

Retroactive to March 18, 2020, CMS will pay all of the reasonable costs for specified categories of E/M services, if they result in an order for, or administration of, a COVID-19 test and relate to the furnishing, or administration of, such test or to the evaluation of an individual for purposes of determining the need for such test. This would include applicable telehealth services.

For visits and services related to COVID-19 testing, clinics must waive the collection of co-insurance from beneficiaries. Clinics have the option to waive cost sharing for all telehealth services.

For all visits and services in which the coinsurance is waived, FQHCs and RHCs must append modifier CS on the service line.

Claims with the CS modifier will initially be paid with the coinsurance applied, HOWEVER, the MAC will automatically reprocess these claims.

Coinsurance should not be collected from beneficiaries if the coinsurance is waived.